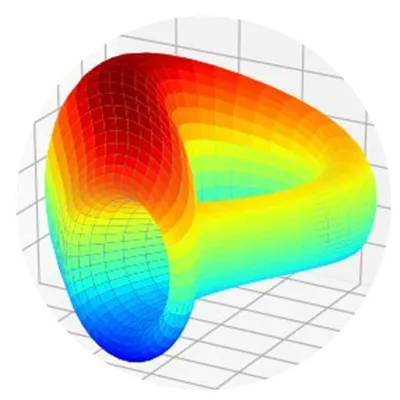

Curve Finance is a decentralized exchange (DEX) specifically designed for stablecoin trading and low-slippage swaps between assets of similar value. Founded by Michael Egorov in early 2020, Curve Finance aims to provide efficient and low-cost trading solutions in the DeFi space. Unlike traditional exchanges, Curve Finance leverages automated market maker (AMM) algorithms to facilitate trades without relying on order books. This approach not only ensures liquidity but also minimizes the price slippage that typically occurs in volatile markets.

Curve Finance Key Features and Functionalities

Curve Finance stands out in the DeFi ecosystem due to its unique features and functionalities:

- Low Slippage and Efficient Trading: Curve Finance’s AMM is optimized for stablecoin trading, ensuring that users experience minimal slippage during transactions. This is particularly advantageous for traders dealing with large volumes.

- Liquidity Pools: Curve Finance supports multiple liquidity pools, each designed for specific types of assets. These pools enable users to provide liquidity and earn fees from trades. Popular pools include the 3pool (DAI, USDC, USDT) and the sUSD pool (sUSD, DAI, USDC, USDT).

- Yield Farming and Staking: Users can participate in yield farming by providing liquidity to Curve’s pools and earn CRV tokens as rewards. Additionally, staking CRV tokens can unlock various benefits, including voting rights and fee discounts.

- Governance: Curve Finance operates under a decentralized governance model. CRV token holders can propose and vote on changes to the protocol, ensuring that the community has a say in its development and direction.

Curve Finance Use Cases and Applications

Curve Finance has a wide range of use cases and applications within the DeFi ecosystem:

- Stablecoin Trading: Traders looking to swap stablecoins with minimal price impact can use Curve Finance for efficient and low-cost transactions.

- Liquidity Provision: Users can earn passive income by providing liquidity to Curve’s pools. The fees collected from trades are distributed among liquidity providers, offering a lucrative opportunity for yield generation.

- Yield Optimization: By participating in Curve’s yield farming and staking programs, users can maximize their returns on digital assets. This is especially appealing for those seeking higher yields compared to traditional financial products.

- Cross-Asset Swaps: Curve Finance facilitates seamless swaps between similar assets, such as different versions of Bitcoin (e.g., wBTC, renBTC) or Ethereum-based tokens (e.g., stETH, aETH).

Curve Finance Roadmap and Future Plans

Curve Finance has an ambitious roadmap aimed at enhancing its platform and expanding its reach within the DeFi space:

- Cross-Chain Integrations: Curve Finance plans to integrate with other blockchain networks, including Polkadot, to enable cross-chain swaps and liquidity provision. This will enhance interoperability and open new opportunities for users.

- Enhanced Governance: The development team is focused on improving the governance model to make it more inclusive and transparent. This includes refining the voting process and enabling more community-driven proposals. // If they used an on-chain governance model like the native one of Polkadot and its parachains they would not have that problem.

- New Liquidity Pools: Curve Finance intends to launch additional liquidity pools tailored to emerging assets and trends in the DeFi market. This will diversify the platform’s offerings and attract a broader user base.

- Layer 2 Scaling Solutions: To address scalability issues and reduce transaction costs, Curve Finance is exploring layer 2 solutions. These enhancements aim to improve the user experience and make the platform more accessible to a wider audience.

Curve Finance and Moonbeam

Moonbeam is a smart contract platform on Polkadot that provides Ethereum-compatible smart contract functionality. As a Polkadot parachain, Moonbeam enables developers to deploy existing Ethereum-based dApps on Polkadot with minimal changes. The collaboration between Curve Finance and Moonbeam brings several advantages to the DeFi ecosystem:

Seamless Ethereum Compatibility

Moonbeam’s Ethereum compatibility allows Curve Finance to easily deploy its platform on Polkadot without significant modifications to its existing codebase. This compatibility ensures that users can enjoy the benefits of Polkadot’s scalability and interoperability while using familiar Ethereum-based tools and interfaces.

Access to Polkadot’s Ecosystem

By deploying on Moonbeam, Curve Finance can tap into the broader Polkadot ecosystem, gaining access to a diverse range of projects, assets, and user bases. This integration fosters collaboration and innovation, driving the growth of the DeFi space on Polkadot.

Enhanced User Experience

Moonbeam’s focus on providing a developer-friendly environment ensures that Curve Finance can deliver a seamless and intuitive user experience. Users can interact with Curve Finance on Moonbeam using their existing Ethereum wallets and tools, minimizing friction and enhancing accessibility.

Curve Finance offers robust solutions for stablecoin trading and liquidity provision. As the platform continues to evolve and expand, it remains a valuable resource for traders, liquidity providers, and DeFi enthusiasts. By leveraging its unique features and functionalities, users can optimize their DeFi experience and capitalize on the opportunities presented by this innovative protocol. The integration with Polkadot and Moonbeam further enhances Curve Finance’s capabilities, driving interoperability, reducing costs, and fostering a more secure and efficient DeFi ecosystem.

- Related Token/s: CRV